This post may contain affiliate links and WPF may earn money or products from companies mentioned. Our guest post plugin stopped working! Please note that the authors listed may not be accurate here 🙁 More info

Financial Stability and Mutual Aid: A New Way to Think About Saving

If you’re here reading this and haven’t yet been turned off by our “politics” talk, you probably consider yourself a liberal, or a progressive, or a leftist. Or maybe none of those labels feel good, but you definitely want a world where people and the planet matter more than profit.

That also means you’ve probably struggled with yourself around the whole concept of “hoarding” money for your future self when there is so much suffering around us. So today, I’m here to talk you through the reasons why I see long term savings and financial security as resistance, and something that should be a top priority, especially in our younger (<50 year old) years.

You’ve probably heard the term “put your own oxygen mask on first,” at least in terms of flying safety. It is really, really true when it comes to our money. If you are currently living paycheck to paycheck, I’m going to say something that might be a hard one to stomach:

If you’re not even saving $100 a month, you shouldn’t be giving $10.

If you’d be wiped out by a $1,000 emergency, then you would need one hundred of you to pool your $10 together to bail out one person’s $1,000 emergency. The goal isn’t to keep passing around that same $10 to try and keep everyone just barely afloat; the goal is to take yourself out of the circle that needs that $1,000. And someday, to be the person who can gift (or lend) $100 or $500 or more when it’s needed. But first, let’s get to a place where we’ve stabilized ourselves.

Those of us who are parents especially know the phrase “you can’t pour from an empty cup” when it comes to our time and energy. But the same is true for our money – we cannot give away what we don’t have.

But mutual aid doesn’t just involve sacrificing our own emergency funds and retirement savings to others we see as “more deserving” of stability than ourselves. Especially when you’re younger, you likely have other things to offer your community: physical labor, intellectual skills, sharing of resources. Mutual aid looks like mowing an older neighbor’s lawn, watching a pet when a friend goes out of town, or batch cooking a meal and sharing it with someone who’s under the weather.

If you’re thinking about mutual aid only in terms of money, you’re still trapped and thinking within a capitalist system. How can you reimagine capitalism if you’re only way of thinking about mutual aid is money? Mutual aid is mutual – meaning that some folks provide money, some shared resources (like a dehydrator – not everyone needs their own!), some their time and labor.

If all mutual aid looks like is donating money, then it’s just charity. Yes, “just give people money” rather than making them jump through endless hoops is a very good thing. But mutual aid is not the same, and we shouldn’t be treating it as such.

So, have I convinced you that maybe, just maybe, you deserve to be financially stable so that you can then better show up for your community?

In a future newsletter, we’ll dig further into the how of saving and investing, but for today, let us convince you that it’s not too late.

Let’s talk compounding. Because the younger you are, the less you need to save. While this is extra true the younger you are (compounding from age 20 to age 70 is freaking magic), it’s true even when you’re starting at 40.

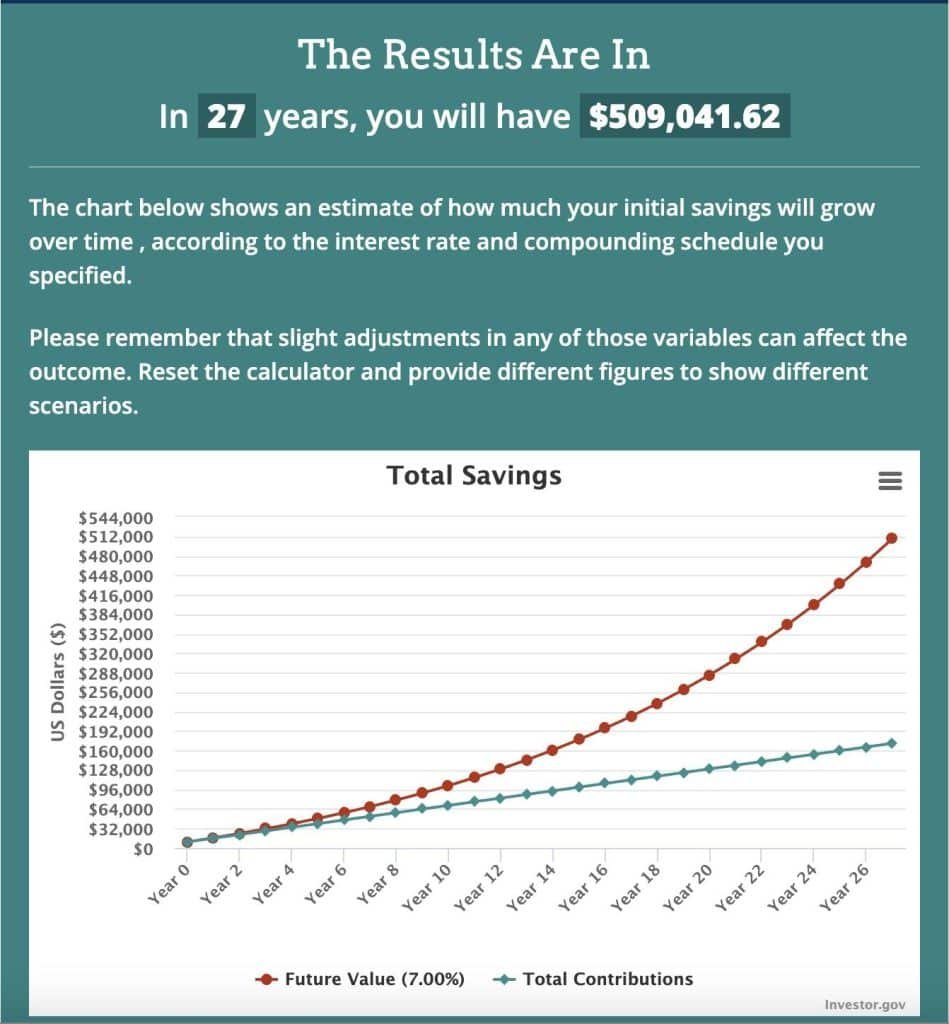

So let’s say you are forty years old and have $10,000 saved for retirement. It may feel like a hopeless waste trying to save the million dollars or more that you’ve probably heard that you’ll need. But starting right now, you have twenty seven years until age sixty seven. 27 years is a lot of time left.

If you can find a way to contribute $500 a month – $6,000 a year – you could end up with over half a million dollars by age 67.

Combine that with a partner, if you have one, and that’s a million dollars by retirement age. $500 absolutely may feel like a lot, especially if you’re currently just squeaking by each month, but it is a doable number for most of us. Truly. And even better? Every $50 you shave off your budget in a long term, sustainable way, the less money you need to save for retirement, because your life costs less overall.

One small way to save more than $50 every month? Consider swapping your phone bill with Mint Mobile – their plans start at just $15 a month per device, and they use the T Mobile cell towers. Make that swap, and put that money into your retirement savings instead.

If you’re thirty five instead of forty, that monthly savings amount drops to $320 from $500 to end up with the same amount of money.

And if you’re only twenty years old? $68 a month for the 47 years until you hit 67 (!!) Or $129 a month if you don’t start with the initial $10,000 nest egg.

Want to play with this compounding calculator? I use this basic free one, and input a 7% return (10% historical average for the stock market + 3% reduction for long term average inflation)

It may be frustrating to see these compounding numbers as you get older, realizing you’ve missed out on that massive longterm growth, but what it means is this: every year you wait to save money toward retirement is a guarantee that you would need to save a whole lot more in order to have that comfortable cushion when you need it. Start now. Even if it’s “just” that $10 a month. You are taking care of your future self, and she deserves to be cared for.

If today we’ve convinced you to start looking at your finances a little more closely – even if it’s scary – here are a few ways to start:

- Open a note in your phone, or use a physical sheet of paper. Spend the next week writing down every single purchase you make, without judgement. Before we can determine where we can make changes to our monthly spending, we need to know what our spending actually looks like. It may not feel like you’re spending on a bunch of random stuff, but until you’ve done this, you won’t really know. (We’ve been loving seeing people post online about how much money they’ve saved by boycotting Target and/or Amazon – but dang it can be sneaky how much money you spend on accident and on little <$20 purchases)

- Commit to one area where you’re going to go hard this next month. Maybe that’s cooking all your food at home. Maybe it’s doing a sober month. Maybe it’s doing a mini clothes buying ban. Maybe it’s only meeting up with friends in free ways. Don’t look to change everything all at once. And be sure to include joy every month, even when you’re looking to make these shifts.

- Join us at our live Zoom event in August 2025 where we talk about how we manage our money (more details down in the events section!)

- Download the Empower money app (free – we’ve both used it for the better part of a decade). It’s a great way to both review your credit card statements and track your net worth long term. We’ll be talking it through at our August event, and you’ll be more ready to go if you’ve set it up in advance.

- Make sure you have people in your life who are aligned with where you want to be financially. They don’t have to make a ton of money, but they should understand why you’re choosing to meet up at the park for a potluck instead of going out for brunch every time you meet up. Those wonderful people can be great for swapping rarely-used items or hand me downs as well.

Note: all of these thoughts today are underlined by the fact that we believe that basic food, housing, healthcare, and childcare should be truly accessible for everyone. If we had a system that worked better for the majority of us, we wouldn’t need to be so dependent on nonprofits and charities and mutual aid groups. But until we (hopefully) get there someday, we’re going to keep talking through ways we can be financially stable and resilient, even within the capitalist, overconsumptive society we find ourselves in.

Love this post? It was originally shared in our weekly newsletter, WPF’s Tuesday Tapestry. Get more like this, weekly in your inbox. Sign up here!

Leave a Reply