The election could have a big impact on our wallets. Washington Post columnist Catherine Rampell explains how.

We are right on the eve of what is going to be a truly pivotal election. And this year, more than many others, it seems there’s a unique urgency in the air. At least part of that is because each candidate has pledged to make changes to critical facets of American life — including to our personal finances.

We’ve heard from both candidates that they want to do things like make it easier to buy a house, care for aging parents, or even change the way you get paid if you’re someone who relies on tips, but it’s hard to know how any of these proposals might actually work in practice, or even the likelihood they’ll get implemented.

Further complicating things is an awareness gap; according to YouGov, 74% of Harris supporters can correctly identify her policies, and 64% of Trump’s supporters can confidently pinpoint his. In other words, many voters may head to the polls with only a partial understanding of the specific platforms they’re endorsing.

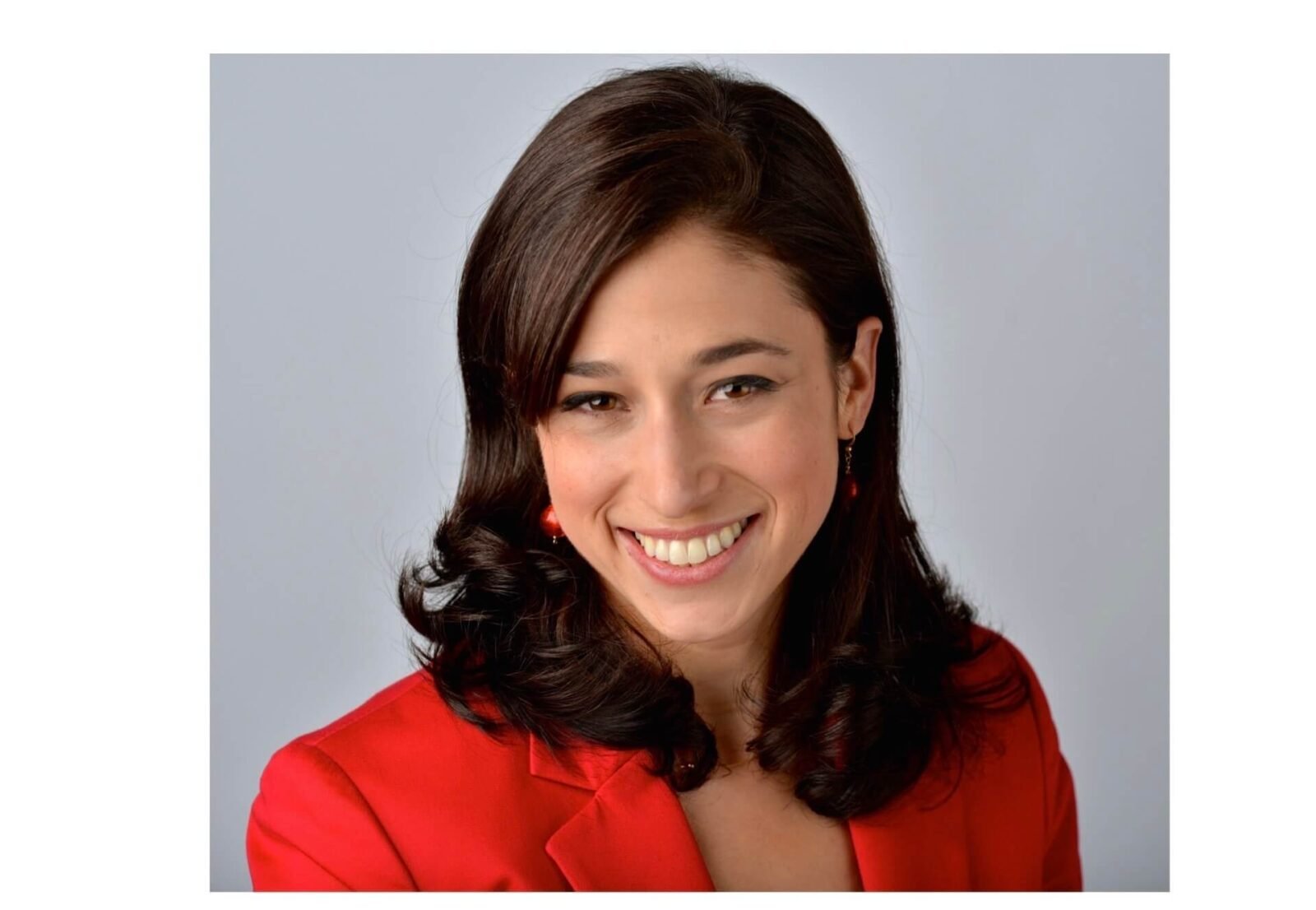

Catherine Rampell, nationally syndicated opinion columnist at the Washington Post, helps us dissect the issues and how the 2024 election can impact the broader financial system (and our personal economies).

INFLATION

Inflation is one of the highest priority issues for most American voters. In a recent Gallup poll, 52% of candidates said inflation has an “extremely important” influence on their vote. So can Harris or Trump’s policies influence price stability? Catherine Rampell says not much.

“Presidents actually have very little control over price levels. They can do relatively few things to bring prices down,” Rampell says. “There is, however, quite a bit that they can do to make inflation worse, and on that score, Trump’s agenda is uniformly worse than Harris’s.”

That’s because Trump’s agenda, and his proposal to impose universal tariffs, would likely raise prices on a lot of goods, including the fruits and vegetables we buy at the grocery store and the imported goods we get at other stores.

STUDENT LOANS

While Trump hasn’t said much about how he plans to tackle the 1.6 trillion dollars of student loans that Americans owe, Kamala Harris has proposed expanding Pell Grants, and offering “more along the lines of the Biden administration’s one-time student debt forgiveness that was blocked by the Supreme Court,” Rampell says.

“The Biden administration has tried to revamp the student loan program going forward so that there’s basically a more generous version of income-driven repayment programs,” Rampell says. “So it means people can qualify for forgiveness sooner after they graduate. And their payments in the meantime are capped at a lower rate.” While the courts have blocked them up until this point, Rampell says that, if elected, Harris would likely continue to push for these kinds of reforms.

SOCIAL SECURITY

Rampell says that while “both candidates have kind of tried to present themselves as the guardians or saviors of the Social Security system, the Social Security system is going to be under great financial strain, whoever is President.”

Under Trump’s agenda, Social Security benefits would be tax-free. For many Americans, that’s a very popular idea. But, Catherine Rampell warns “if you look at how the system works right now, for lower-income and middle-income households who receive Social Security benefits, those benefits are already either completely tax-free or mostly tax-free.”

Harris’s proposals on Social Security are not as clear. “She’s talked about raising taxes in general on higher income people, on corporations, and that will pay for a bunch of the expansions of the safety net. Harris may not make things a whole lot better, but Trump would probably make them a lot worse,” Rampell says.

BOTTOM LINE

The 2024 election is shaping up to be a critical turning point, with each candidate promising significant changes that will likely impact our personal finances in some way.

With each candidate offering different ideas on how they will lower inflation, shore up Social Security, and handle our student loan debt, voters should think about how these potential policies could shape their wallets—and their futures—in the years to come.

MORE ON HERMONEY:

More money news when you need it! Get the latest and greatest updates on all things investing, budgeting, and making money. Subscribe to the HerMoney newsletter at Hermoney.com/subscribe!

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Leave a Reply