This past April, life delivered a lot of things I had been waiting on for a long, long time.

Four of them were books. REALLY good books by authors I respect a lot.

Not too long after they arrived, though, I got another piece of (fantastic) life-changing news. It was a huge opportunity, but it required a lot of time and attention to fully take advantage of it.

And all that beautiful energy unfortunately took me away from my book reviews.

Here we sit, six months later, and I’m excited to FINALLY catch you up on some of my favorite new personal finance books in 2024.

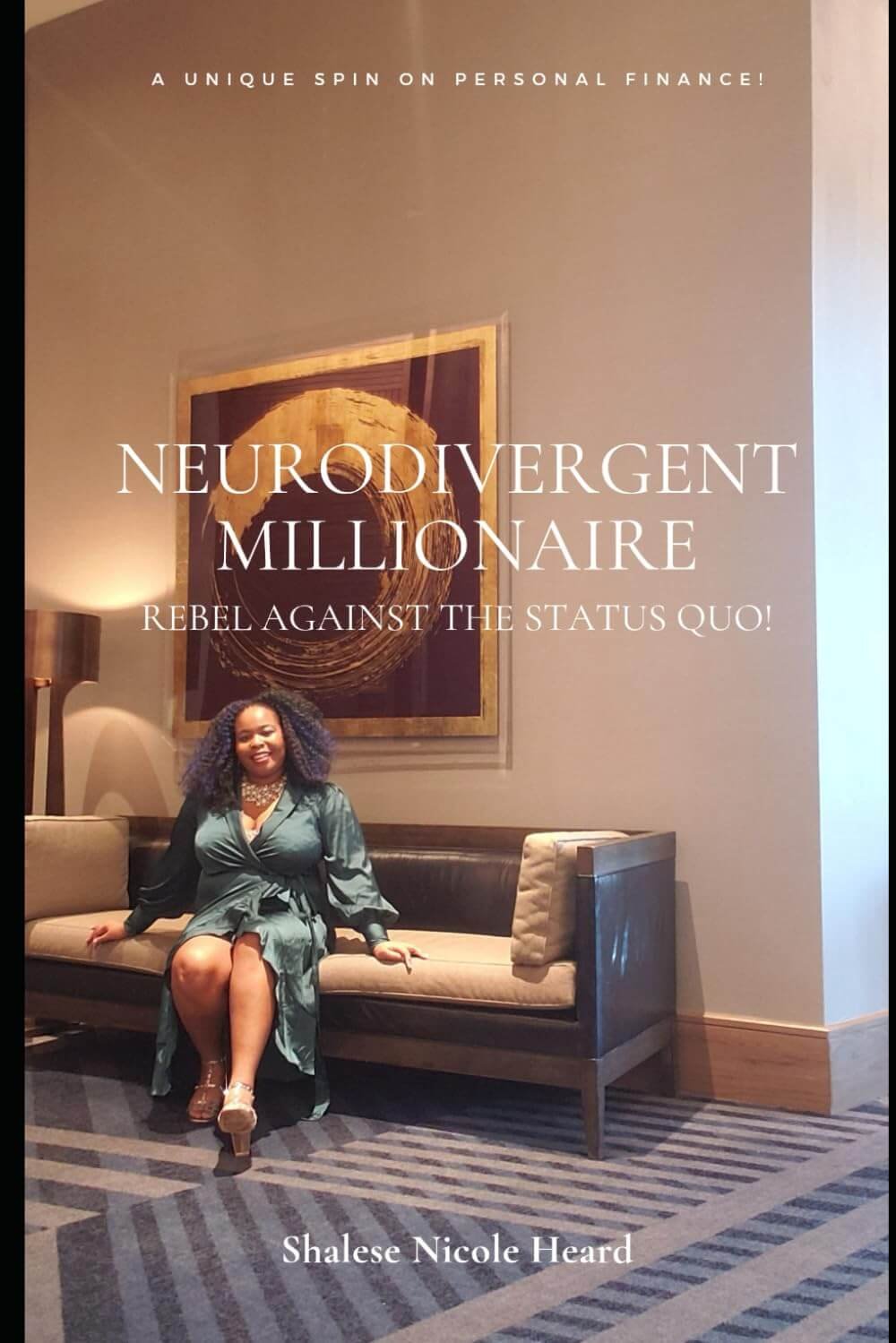

Let’s start with Neurodivergent Millionaire by Shalese Heard!

About the Author

As a Femme Frugality reader, you’ve likely heard Shalese’s name before. I’m so drawn to her work.

Shalese has gone by a couple different brand names over the years. You may recognize her as the Autistic Travel Goddess. We talked travel, Autism and entrepreneurship on the Mom Autism Money podcast a couple years ago. We’re not actively working on the podcast anymore, but it’s still worth a listen — one of my favorite interviews!

Now you can find her on the internet as the Neurodivergent Millionaire, hence the book title. 🙂

About the book

If you’re looking for a quick read that will leave a huge impact, this is the book for you. Shalese powerfully covers a lot of territory in this tome. Let’s get into it.

Frees you from debt shame

The book may be short, but it’s jam-packed with a ton of liberating information and ideas. I think one of the most powerful for all readers is the destigmatization of debt.

In America, there’s this weirdly religious morality that sits in shadow over debt in most financial media. There are historical reasons for that, but we won’t get into them here. Conversation for another day.

What Shalese does in the Neurodivergent Millionaire is free you from all that. She makes it abundantly clear that the big lenders in this country aren’t looking out for you, so you shouldn’t look out for them — and you also shouldn’t fall victim to their scare tactics.

Now, in the short pages of this book, Shalese covers several circumstances where it’s not necessarily to your advantage to pay off debts if you’re already in a hole. Especially if you’ve been in that hole for quite a long time. The book is incredibly valuable for pointing out those circumstances, as not many personal finance books do.

It is just a short overview, though. Credit and debt are frustratingly complicated and nuanced. There’s a legal framework for debts that can vary by state, and then there’s an entirely separate credit rating system. (Systems, really. You can have multiple FICO scores depending on which type of lending product you’re applying for, and FICO isn’t the only scoring model although it is the one most commonly used by lenders.)

Because it’s so concise, I’d encourage you to use this book as a starting point. It can open your eyes to circumstances where you may have more options for managing your debt than you’d think — including nonpayment.

But again, these issues are complex. You’ll still need to do further research to find out if nonpayment or any of the other strategies outlined are truly the right move for your specific situation. Without doing that further research, you could incur potentially negative consequences, like lawsuits, wage garnishment or negative reporting on your credit depending on where you live, how old your debts are and other mitigating factors.

Redefines freedom

In the Neurodivergent Millionaire, Shalese makes an excellent argument that monetary abundance does not necessarily equate to financial freedom. Tying yourself to status, possessions and an overcommitment to labor can leave you in a situation where someone who earns less actually has more freedom than you do.

It’s an incredibly smart perspective, and one you’ll want to read more about in the book’s pages.

Gives you permission to manage your money and life neurodifferently

When you’re neurodivergent, you have to combat a lot of ableism. That may manifest in your workplace. It may manifest in toxic relationships, whether that be with your family, roommates or other members of your social circle. It can even manifest in how you’re told is the ‘right’ way to manage your money, or influence whether or not you apply for government benefits that could actually help your money and financial freedom situation.

Shalese deconstructs all of these topics through real-life examples and hard math. Her book can open your eyes to pathways that you may have been shamed out of pursuing in the past, empowering you to live life differently and be proud of it — regardless of what anyone else thinks.

Recommend?

Spoiler alert: I’m going to highly recommend all the books I was so excited to see arrive on my doorstep!

And Neurodivergent Millionaire is no exception. Whether you’re Autistic or otherwise neurodivergent, this is a book you’re going to want to pick up. It gives you permission to live life on your terms, and empowers you by erasing a lot of the shame you’ve been unfairly subjected to throughout your life.

If you’re neurotypical or don’t even know what all these neuro words mean, I’m also going to encourage you to pick up a copy. It is always a good idea to expose yourself to ways people different from you experience the world, and when it comes to something as systemically discriminatory as money, it becomes particularly important.

Reading about these topics from another perspective allows you to deconstruct some of the ways you may unintentionally participating in discriminatory systems, and be more sensitive about the ways you talk about things like finances.

Because it’s not a one-size-fits-all kinda topic.

Leave a Reply