Why, hello, hello.

It’s been a minute since we’ve talked.

I swear I didn’t fall off the face of the planet.

Instead, I’ve been hard at work on a new project.

Allow me to introduce you to DISABILIFINANCE.

What is DISABILIFINANCE?

DISABILIFINANCE is an educational platform for financial professionals. We’re bringing you learning modules on disability finance topics taught by top experts across the fields of:

- Financial planning

- Law

- Self-advocacy

- Social programming

- And more!

Why should I care about disability finance?

When you’re disabled, the various systems you interact with affect your money in a big way. They can lead to forced poverty or inflict marriage inequality on the basis of disability — and that’s on top of actually needing more financial resources because of the way our society is set up.

Obviously, you’re likely to care about disability finance if you’re disabled or have a disabled family member. But if you’re a financial professional, learning about disability finance is important for you, too. Some of the top reasons why this is especially true in 2024 is:

- Diagnoses of childhood disabilities have gone up over the past 10 years. That means even if you don’t have clients who are disabled or have disabled children today, that could change in the future. Getting educated prepares you to know how to work with these clients.

- A shocking number of Americans become disabled before retirement age. This was true before COVID, but the numbers are going up thanks to long COVID. The population that needs these services is larger than it used to be, so gaining some literacy in this space is a smart move.

- Most people want to live as long as possible. That means aging, and aging populations are a part of the disability community. Whether they adopt a disability identity or not, aging clients tend to interact with many of the same programs as younger disabled people, making this topic an important one for long-term financial and tax planning.

- At the very tail end of 2022, the ABLE Age Adjustment Act passed. It nearly doubles the number of people eligible for ABLE accounts effective in 2026. One population that is especially affected by these changes is veterans, who make up about 1 million of the newly-eligible Americans. Now is the time to get ready by learning as much as you can about these specialized 529s!

- Disability finance is not intuitive. I cannot stress this enough. The rules baked into these social programs and financial products hardly ever make logical sense, and are often harmful for no good reason. If you assume you know how a program works based on logic, you’re probably going to end up leading your clients astray — and that’s a big deal when we’re talking about their money. Learning about these nuances can help you better identify when you need to bring in fractional services.

What topics does DISABILIFINANCE cover?

You’ll find educational webinars on topics like:

- ABLE accounts

- Guardianship (and its alternatives)

- Marriage penalties for disabled clientele

- Supplemental needs trusts (SNTs) and estate planning

- Soft skills you should learn before interacting with the disability community

- Programs like Medicaid and Medicare

- Disability discharge of federal student loans

- Planning for the transition to adulthood

- Life insurance needs

- Disabled entrepreneurship

Can I earn continuing education credits through DISABILIFINANCE?

You sure can! Currently, DISABILIFINANCE is a CFP Board CE Sponsor, which allows CFP professionals to earn CEs when they attend one of our live webinars.

We hope to add continuing education credits for other financial professionals in the near future. You may be able to get pre-approval with your certifying board depending on your profession even though we only have CFP Board CEs to start.

For example, if you’re an accountant, the state agency that approves your CPA professional education credits may approve a DISABILIFINANCE webinar if you ask in advance.

Who is allowed to take a DISABILIFINANCE course?

Anyone! While CFP certificants will benefit the most right now, you don’t have to take the course for CEs. The courses are structured in a way to meet these CE requirements, so we will be sticking to a specific format with that audience in mind, but this is education anyone can access.

Examples of people who may want to attend a live webinar include:

- Disabled people or parents of disabled children. (Or other family members who are involved with these financial systems at any stage of life.) While no one session can be considered a complete education across all financial topics or specific advice for your specific situation, if there’s a topic you have an interest in you’re more than welcome to join us. (You’re also more than welcome to tell your current CFP professional about our courses so they can better serve you!)

- Other financial professionals. Again, we’re going to add continuing education credits for other financial professionals soon. And you may be able to gain pre-approval for credits as things stand. Regardless of educational credits, these courses can help inform you in your respective field.

- Financial writers or content creators. If you want to craft empathetic and informed content for a growing portion of the American population, these sessions can serve you in a big way. You’ll have the unique opportunity to learn directly from some of the top experts in this field.

Where can I sign up for courses?

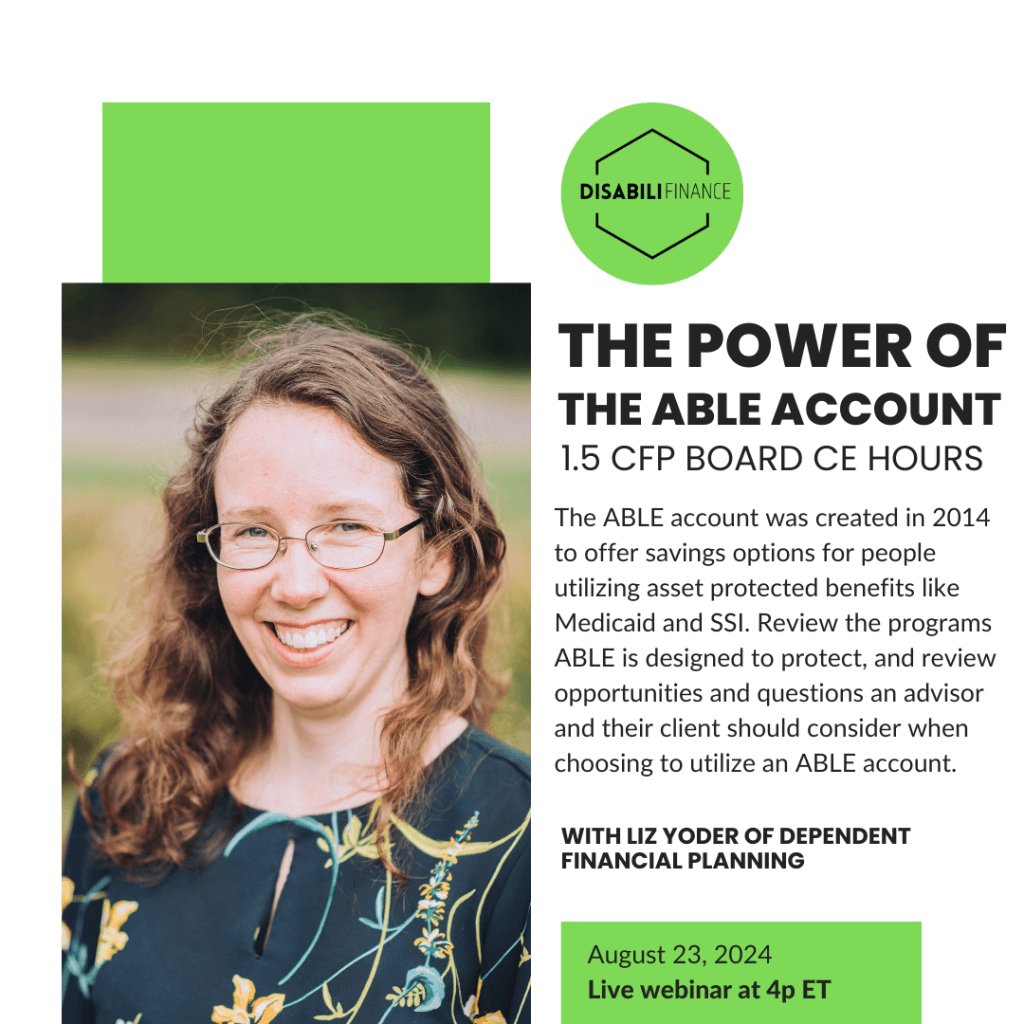

We have a few sessions in the pipeline, but the first is The Power of ABLE Accounts on August 23, 2024. The sign-up page is live, so you can get your ticket today!

This session will be led by Liz Yoder of Dependent Financial Planning. Liz is one of the most knowledgeable financial planners I’ve encountered in this space. Here’s her bio:

Liz Yoder studied Speech Language Pathology and Audiology at Loyola College in Maryland. She moved soon after graduation into a supportive group home, where she was a live-in caregiver to four adults with Intellectual and Development Disabilities (IDD). Liz got introduced to the IDD advocate community and became determined to work for families and individuals who were often scared to save or earn too much to disqualify them for government benefits. Liz became a CERTIFIED FINANCIAL PLANNER™ professional to advocate with them. In 2023, Liz founded Dependent Financial Planning. She serves clients across the country, many with high support needs and many with few. Liz knows that these families are often told what they can’t do. Liz works to find a path to what they can.

There’s another session I’ll be announcing later this week — stay tuned by subscribing to the DISABILIFINANCE newsletter!

Leave a Reply